Often in a commercial setting, the tenant of your premises will be a company as opposed to an individual or a group of individuals.

What does that mean for you as a landlord?

The biggest implication is that a company has limited liability and is often used as a vehicle to limit the personal liability of the directors. The directors, or people who stand behind the company and make the decisions, are not exposed to losses or damages (except in very limited circumstances). Rather the company is a distinct legal entity that enters into the lease transaction in its own right.

If the company has a solid reputation and strong financial backing and experience, this should not present too much of an issue. However, problems arise when the company has little or no assets or access to liquid funds if the business does not go as planned. If financial difficulties arise, and you can’t recover your losses directly from the company, you will not be able to recover any losses personally from the directors.

There are three generally accepted options when entering into a lease with a tenant corporation:

- you can require the directors to personally guarantee the obligations of the company , which will enable you to recover losses directly from the directors. Or,

- you can require a larger deposit amount , or

- you can require a bank guarantee .

The benefit of a larger deposit amount is that they are faster, easier and cheaper to access should things turn sour. However, they are for a finite amount and may not cover all of your losses.

On the other hand, taking a bank guarantee, may enable the tenant to provide more security (say, up to 12 months’ rent plus outgoings), while not effecting the company’s cash flow.

A director can give a personal guarantee under the terms of the lease, where he or she guarantees the obligations of the company. Unless agreed otherwise, the liability imposed by a personal guarantee is unlimited and may be advantageous, particularly where the individual has a high asset base and access to funds. Personal guarantees can however, be time-consuming and costly to enforce

Of course, the preferred position for the landlord would be to secure a large security deposit (or bank guarantee) in addition to personal guarantees from the directors of the company.

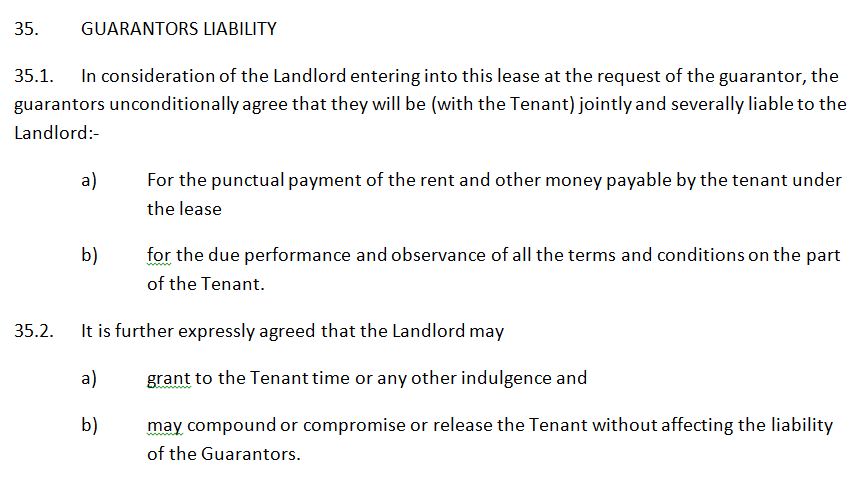

If the directors are providing guarantees, they need to be a party to the lease in their individual capacities as Guarantors and the lease needs to include a special guarantee provision. Additionally, the director will need to sign the agreement in his or her own right as Guarantor, as well as in their capacity as director of the company as tenant.

Sample guarantee provision

All of RP Emery’s Commercial and Retail Leasing kits include provision for Directors guarantees.